As part of efforts to combat blackmoney and fake currency through demonetisation, government agencies have conducted over 1,100 searches and issued 5,100 notices to verify suspicious high-value cash deposits.

This led to seizure of valuables worth over Rs 610 crore, of which as high as Rs 513 crore were in cash.

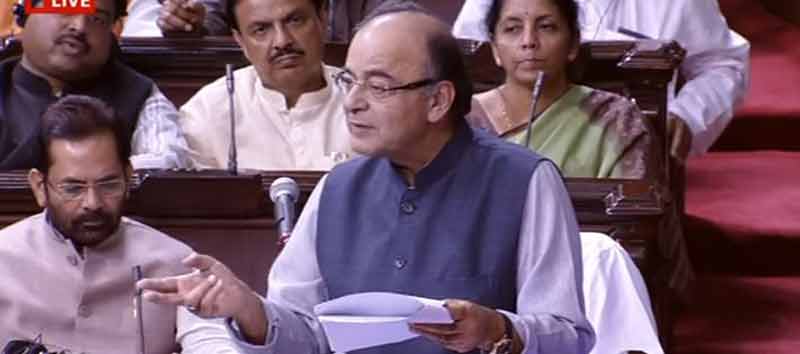

“Post demonetisation, during November 9, 2016 to January 10, 2017, more than 1,100 searches and surveys were conducted and more than 5,100 notices were issued by the Income Tax Department for verification of suspicious high-value cash deposits,” Finance Minister Arun Jaitley said in a written reply in the Lok Sabha on Friday.

He was responding to a query on the extent to which the government has achieved its objective of the cash ban announced on November 8.

The seizure of the money in the whole exercise so far has involved Rs 110 crore in the form of new currency notes (of Rs 500 and Rs 2,000).

“The undisclosed income detected in these ongoing investigations till January 10, 2017, was more than Rs 5,400 crore,” he said.

File photo: Wads of new Rs 2000 notes seized by law enforcement agencies.

In a separate reply, Minister of State for Finance Santosh Gangwar said relevant information has been shared by the I-T Department with other law enforcement agencies such as the Enforcement Directorate and the Central Bureau of Investigation for appropriate action.

“As on November 8, 2016, there were 17,165 million pieces of Rs 500 and 6,858 million pieces of Rs 1,000 in circulation. The value of specified bank notes of Rs 500 and Rs 1,000 returned to RBI and currency chests amounted to Rs 12.44 lakh crore as of December 10, 2016,” Gangwar said.

Jaitley said demonetisation seeks to create a new normal wherein GDP would be “bigger, cleaner and real”.

“This exercise is part of the government’s resolve to eliminate corruption, blackmoney, counterfeit currency and terror funding,” said the finance minister.

The government is taking steps such as collection of requisite information from various sources, conducting investigations in appropriate cases, searches, surveys, assessment of income, levy of penalty and launching of criminal prosecution to curb blackmoney, he said.

Formation of the special investigation team (SIT) on blackmoney, enactment of comprehensive law, Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, amendment of the Benami Transactions (Prohibition) Act, 1988, are among other measures taken by the government to weed out blackmoney inside and outside the country, he said further.

In reply to a question on action taken or proposed against offenders, Gangwar said it is an ongoing process and a number of effective measures have been taken to verify cash deposits in old Rs 500 and Rs 1,000 notes in banks by those whose case deposits were not in line with their existing profile based on filings with the tax department.